Welcome to Strativ’s Accounting Services

With over two decades of experience in the accounting and finance sector, we are your premier partner for managing and navigating the complex world of business finances. Our expertise is not limited to just one type of business; we cater to the dynamic needs of small, venture-backed companies experiencing growth, as well as large multi-national corporations seeking to augment their staff.

Unlock the Power of Data-Driven Financial Insights

In today’s dynamic business landscape, strategic financial management is essential for driving growth and making informed decisions. At Strativ, we empower businesses with comprehensive finance solutions that enable you to harness the power of data and unlock valuable insights. Get started with our blueprints for your startup and take control of your financial success.

Who are we?

- STARTIV is a premier AFM (Accounting, Finance, and Management Consulting) firm, integrating processes, people, and technology seamlessly.

- We collaborate closely with your team to enhance efficiency, boost visibility, and enhance access to crucial information at all levels.

- We empower clients to capitalize on opportunities and overcome challenges effectively.

- Through our proven expertise, intensive staff training, and personalized guidance, we bring about significant improvements and cost savings for our clients.

- Our streamlined workflows ensure real-time information access, transparency, and prompt responses, allowing clients more time to focus on strategic and business development initiatives.

- Each member of our team is thoroughly trained in accounting and reporting.

- We liaise with auditors on behalf of our clients for any accounting or finance-related concerns.

Why choose STRATIV?

We are here to provide support and guidance through every step of your business and financial journey. Ensuring you have all necessary information and assisting with planning to optimize business efficiency is our priority. Selecting someone to handle your accounts is a critical decision. It’s essential to find an expert whom you can also trust. Our aim is to help you expand your client base and increase your revenue while keenly managing costs.

At Strativ, we pride ourselves on our expertise in a comprehensive suite of software tools designed to streamline and optimize your financial operations.

We understand that every business is unique, and we tailor our services to meet your specific needs. With our extensive experience and comprehensive suite of services, we are equipped to handle all your accounting needs, driving your business towards growth and profitability. Let us be your trusted partner in achieving financial excellence.

Key features include:

- High customer satisfaction

- Tax savings

- Quality service

- Honesty

- Timeliness

- Effective communication

Software expertise includes:

- Netsuite

- Intacct

- QuickBooks

- Xero

- SAP

- Salesforce

- Oracle JD Edwards

- PowerBI

- Bill.com

- Expensify

Accounts Receivable

Accounts receivable represents money owed to a business by its clients or customers. Efficient management of accounts receivable is essential for maintaining healthy cash flow and minimizing bad debt. Key steps in the accounts receivable process include:

- Improving collection times.

- Developing a collection plan and documenting the process

- Incentivizing early payments through discounts

- Building strong client relationships

- Implementing strategies to ensure timely payments

Our Accounts Receivable Process Overview includes:

- Customer master creation

- Invoice creation for down payments and progress payments

- Customer collections follow-up

- Online invoicing on customer portals

- Cash applications and reconciliation

Accounts Payable

Accounts payable is a vital aspect of business operations, representing the liabilities owed by a company to its creditors. Effective management of accounts payable is crucial for maintaining financial stability and credibility. Some key steps in the accounts payable process include:

- Verifying invoice accuracy and matching with purchase orders

- Confirming receipt of goods or services

- Ensuring correct unit costs, tax calculations, and other details

Our Accounts Payable Process Overview includes:

- Posting PO and non-PO invoices in the AP tool

- Handling supplier disputes via email

- Payment check runs

- Agent commission payments

- Intercompany accounts netting

- Reconciliation processes

Financial Reporting

Financial Reporting involves the meticulous recording and organizing of financial transactions, ensuring accurate financial reporting and compliance with regulations. A skilled bookkeeper can handle various tasks, including payroll management, financial reporting, and tax preparation. Our Bookkeeping service includes:

- Bank and credit card reconciliations

- Income and expense report management

- Monthly financial statements

- Sub ledger reconciliation

- Prepaid and fixed assets schedule maintenance

- SOX compliance support

Inventory and Costing

Inventory management and costing are critical for businesses that deal with physical goods. Proper tracking and valuation of inventory assets are essential for accurate financial reporting and effective business planning. Our Inventory and Costing Process Overview includes:

- Cost roll calculations

- Inventory reporting and analysis

- PPV review

- Cycle count reporting

- Gross margin analysis

- Cost of sales tie-out

General Ledger and Financial Reporting

Efficient financial reporting and analysis are essential for gaining insights into a company’s financial health and making informed decisions. Our General Ledger and Financial Reporting Process Overview includes:

- Booking recurring journal entries and reclassifications

- Sub ledger reconciliation

- Prepaid and fixed assets schedule maintenance

- Deferred revenue tracking

- New business workings and reporting

- SOX compliance support

Payroll Management

Our Payroll Management service simplifies the payroll process for businesses, ensuring accuracy and compliance with regulations. Our comprehensive payroll solutions include:

- Employee data management

- Accurate salary calculation

- Employee life cycle management

- Best practices implementation

- Reporting for decision-making

- Deductions and filing

- Management reports

FP&A (Financial Planning & Analysis)

FP&A involves the development of financial forecasts and strategic planning to support decision-making within an organization. It plays a crucial role in budgeting, forecasting, financial modeling, and performance analysis. Our FP&A services help businesses optimize financial performance and achieve their strategic objectives. Some key components of our FP&A process include:

- Budgeting and forecasting

- Financial modeling and scenario analysis

- Variance analysis and performance reporting

- Long-range strategic planning

- Capital expenditure analysis

- KPI (Key Performance Indicator) development and tracking

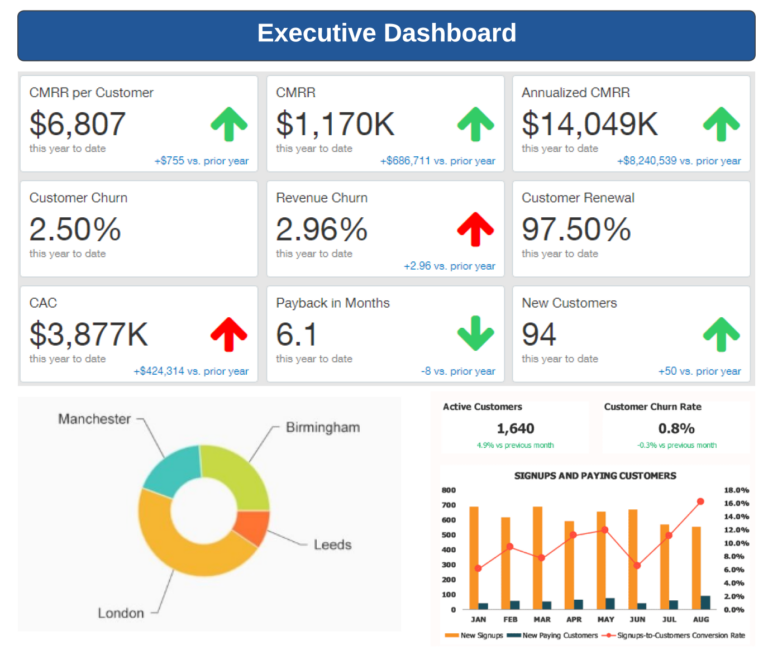

FP&A Reports

Our FP&A reports provide valuable insights into a company’s financial performance and help stakeholders make informed decisions. Some of the reports we offer include:

- Budget vs. Actuals: Comparing actual financial results with budgeted figures to identify variances and performance trends.

- Rolling Forecasts: Updated financial forecasts based on current performance and market conditions to support agile decision-making.

- Financial Dashboards: Visual representations of key financial metrics and performance indicators for quick and easy monitoring.

- Scenario Analysis: Evaluating the impact of different scenarios on financial outcomes to support strategic planning and risk management.

- Profitability Analysis: Assessing the profitability of products, services, customers, or business segments to optimize resource allocation and pricing strategies.

- Cash Flow Forecast: Projecting future cash inflows and outflows to ensure adequate liquidity and support operational needs.

Harness the Power of Data

Our finance solutions are built on the foundation of data-driven decision-making. We help you leverage the vast amounts of financial data within your organization to gain valuable insights into your financial performance, identify trends, and make informed strategic decisions.

Comprehensive Financial Management

With Strativ’s comprehensive financial management solutions, you can streamline your accounting processes, optimize budgeting and forecasting, and gain better control over your financial operations. Our experienced team of finance professionals works closely with you to understand your specific needs and tailor our solutions to align with your business goals.

Guide to Finance and Accounting KPIs

Want to gain a deeper understanding of key financial performance indicators? Get started with our blueprints for your startup and take control of your financial success. These guides will equip you with the knowledge and insights you need to track and analyze the critical metrics that drive your financial success.

Take Control of Your Financial Future

Ready to take control of your financial future? Empower your team with the tools they need to measure and optimize financial performance, drive growth, and make strategic decisions with confidence.

Transform Your Finance Function with Strativ

At Strativ, we understand the importance of a robust and data-driven finance function. Our team of finance experts is dedicated to helping businesses like yours unlock the full potential of their financial data. Contact us today to learn more about how our finance solutions can drive your business forward.

Let's Connect and Create Your Growth Story

Our finance and accounting practice is a team of dedicated professionals who go above and beyond to deliver exceptional financial services. Our talented experts work tirelessly to offer a wide range of comprehensive financial solutions to meet your specific needs. We strive to provide you with the highest level of expertise and assistance, ensuring that your financial goals are not only met but exceeded. While we may not engage in public accountancy practices, our commitment to excellence and unwavering dedication sets us apart, making us your trusted partner for all your financial needs.