Making the Right Financing Choice for a Growing Software Company

Adding debt (or non-dilutive capital as some like to call it) can be a flexible option for your growing SaaS company. In our concluding chapter, we dive deeper into the decision-making process between a revolver loan and a term loan, considering our unique financial needs, growth prospects, and risk appetite. Some companies bolt on a revolver, others will go for a term loan or even both. I’ve done combinations in the past.

Revolver Loans: Leveraging Flexibility for Growth

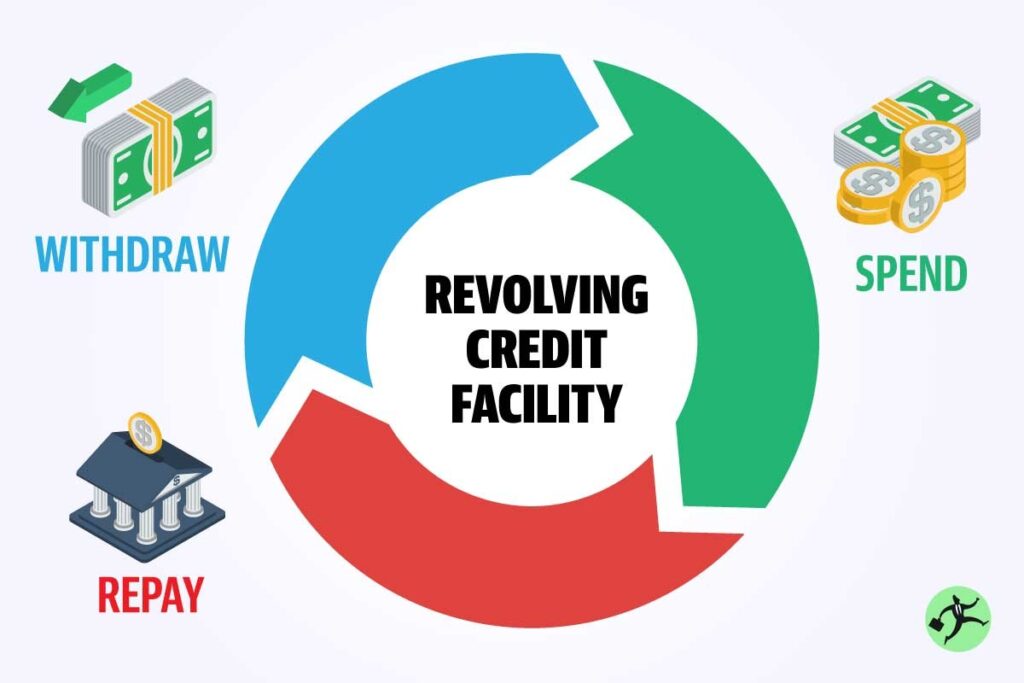

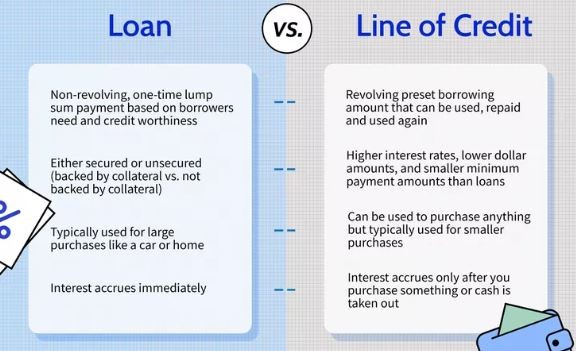

Revolver loans offer our startup a revolving line of credit that can be tapped into for various reasons. The appeal of revolver loans lies in their flexibility and convenience. We can access funds as needed, depending on factors such as our ARR, cashflows, and burn rate. The interest rates for revolver loans typically depend on our specific situation, often around the Prime Rate plus 1.50% or more.

What is the Right Size of a Bank Revolver?

Banks and lenders will thoroughly assess our creditworthiness, financial health, and growth potential to determine the size of the bank revolver. They will closely scrutinize our historical financial statements, revenue and cash flow patterns, collateral and assets, Debt Service Coverage Ratio (DSCR), credit history, and debt-to-equity ratio to get the size of a revolver.

The cost of debt can be influenced by the size of our organization. As a growing software company, you may initially face higher interest rates due to your limited operating history and creditworthiness. However, as we establish a stronger credit profile (and bank relationship), the rates should get better.

Typical Revolver Loan Rates for Series A, B and C Companies:

The interest rates on revolving credit facilities for Series A and Series B companies can vary based on several factors. Typically, it’s Prime Rate-based rates with a margin ranging from 1.5% to 3.5% above the Prime Rate. Alternatively, lenders may offer fixed interest rates ranging from around 6% to 11% or more, and once again the rate “depends” on the perceived risk.

When to Consider Revolver Loans:

- Working Capital: To cover day-to-day operating expenses, salaries, R&D investments, or major marketing campaigns.

- Expansion Costs: For scaling operations, entering new regions (such as building out a team in Europe), or expanding a lateral product line.

- Cost Considerations: We must weigh the higher interest rates of revolver loans against their flexibility and adaptability to changing financial environments.

Interestingly, you can have a resolver but not tap into it. Board members are typically risk averse so they will want you to have the option of a resolver ready but they will not want you to actually use it.

Term Loans: Funding Long-Term Investments

Unlike revolver loans, term loans provide a lump sum that must be repaid over a predetermined period, along with interest. They are commonly used for significant or long-term investments, such as equipment and technology acquisitions.

Cost Considerations: Term loans generally have lower interest rates compared to revolver loans, and their fixed repayment terms facilitate budget planning and cash flow management. The interest rates for term loans are influenced by the rate environment (peaky inflation at the moment), your creditworthiness and market conditions (lingering impact from SVB).

When to Think About Term Loans:

- Long-Term Investments: For high-end servers, software licenses, and strategic investments such as in AI or ML technologies.

- Impact of Rising Interest Rates: If interest rates are expected to rise, a term loan can lock in a fixed interest rate for stability and protection against future rate hikes. Where will rates go from here? Hard to say but it does feel the Fed is slowing its rate of increase.

Don’t forget the Additional Terms: Fees and Warrants

Some debt capital investors may request additional terms and conditions for both revolver loans and term loans. These can include various fees like origination, underwriting, commitment, and closing costs. It’s important to carefully review and understand the fee structure to determine the true cost of borrowing. You might think a rate of 6.5% is great but the effective rate may be much higher when you add all the additional fees.

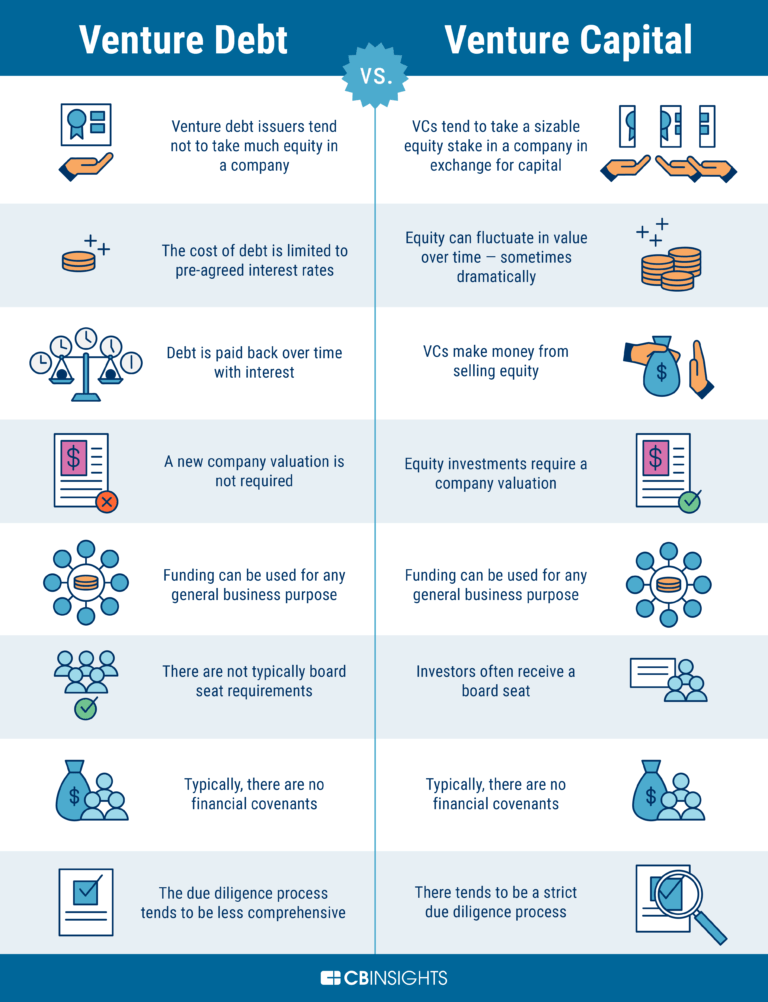

Debt capital folks typically ask for warrants as well which gives them the right to purchase a specific number of shares at a predetermined price within a specified period.

Do the Calculations Ahead of Time

Financial Statements and Projections: Lenders will carefully analyze our historical financial statements, including income statements, balance sheets, and cash flow statements. Our forecasted ARR, customer concentration, and accounts receivable will be subject to scrutiny, allowing lenders to assess our financial performance, stability, and ability to handle debt obligations.

- Revenue and Cash Flow: Lenders will evaluate the predictability and steadiness of our cash flow. Having stable and consistent cash flow is essential to assure lenders that we can comfortably meet our debt obligations, including interest payments on the revolver.

- Collateral and Assets: Startups may need to provide collateral to secure the revolver. Although software companies might not possess tangible assets like inventory, lenders will assess the quality and value of the collateral provided, which significantly influences the credit line size.

- Debt Service Coverage Ratio (DSCR): Lenders will consider your DSCR, measuring our ability to generate sufficient cash flow to cover debt obligations. A higher DSCR indicates a more comfortable management of debt.

- Credit History and Rating: Our credit history and rating will impact the terms we can negotiate with lenders. A positive credit history and good credit rating can lead to more favorable lending terms. Also drop a line every once in a while to your banker to develop some repoire and build on your relationship.

- Debt-to-Equity Ratio: Lower debt-to-equity ratios suggest lower financial risk, potentially leading to a larger credit line.

Final Considerations: Managing Risk and Growth

Ultimately, the choice between a revolver loan and a term loan should be driven by our specific needs, financial situation, and risk appetite. We can consider combining both loans if our business is generating steady cash flow (it’s not unusual to have both done simultaneously).

Do the number crunching, sharpen the pencil on the financial modeling, and consider conservative forecasts to ensure your ability to service these loans effectively.

Costs of Debt:

- Debt costs vary based on factors such as risk assessment, creditworthiness, collateral requirements, market conditions, loan maturity, repayment terms, and lenders’ risk appetite.

- Lenders assess the risk involved in providing debt financing and may charge higher interest rates or additional fees for higher-risk borrowers.

- Companies with strong credit profiles and reliable cash flows are seen as lower-risk borrowers, often receiving more favorable interest rates and terms.

- External market conditions, including interest rate fluctuations impact the cost of debt.

- Longer-term debt generally carries higher costs compared to shorter-term debt, and repayment terms and associated fees also influence the overall cost.

- Different lenders may have varying risk appetites, leading to different costs of debt based on their perception of risk.

Once again, read the fine print and negotiate with your lenders, and don’t go crazy with debt.