Things are a little better these days in terms of the overall environment but as a finance executive, it’s still critical to have a granular pulse on cash and the runway for the business. Accurate cashflow forecasting enables you to anticipate potential cash shortfalls, identify major spend areas, and implement strategies to improve cash inflows.

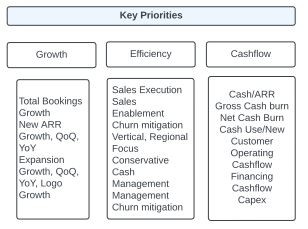

Today we outline a step-by-step approach to forecasting your company’s cashflow over a 13-week period, along with methods to enhance cash coming in from customers. The net of it is an accurate sense of cash at your fingertips whenever the CEO or board asks. And it’s all part of the financial key priorities.

Here’s how we do it:

- Gather Historical Data: Start by collecting historical financial data for at least the past 12 months (18 is better). This information will provide insights into your company’s cashflow patterns, allowing you to identify seasonality or trends that may impact future cashflows (money in and money out)

- Create a Cashflow Forecasting Model: Develop a cashflow forecasting model that incorporates your company’s key financial drivers and variables. These are the things to include in your excel or google sheets model. Here is a free template you can use:

- Revenue Forecasting: Analyze your sales pipeline, historical conversion rates, and existing customer base to estimate future revenue. Take into account factors such as churn rate, new customer acquisition, upgrades, and cross-selling opportunities. Don’t forget the payment terms (hopefully not over 60 days) and the lag for collections.

- Expense Forecasting: Categorize your expenses into fixed (e.g., rent, salaries) and variable (e.g., marketing, software subscriptions). Review historical expense patterns and consider any anticipated changes in the upcoming 13-week period. Some items will be prepared, some items you can delay payables.

- Working Capital: Consider the impact of accounts receivable, accounts payable, and inventory on your cashflow. Adjust these components based on historical trends and expected changes in the business. Most of you will not have any inventories but some of you may have some big capex projects if you have your own data center expense for example and you are not relying on AWS.

- Seasonality and External Factors: Take into account any seasonality or external factors that may affect your cashflow, such as holidays, industry events, or economic conditions. Sometimes big conferences may be prepaid early so it will skew your cashflows.

- Create a Rolling Forecast: Instead of relying solely on a static 13-week forecast, adopt a rolling forecast approach. Update your forecast regularly (e.g., weekly or bi-weekly) to reflect the most recent data and adjust your projections accordingly. This approach allows you to adapt to changing circumstances and make informed decisions based on real-time information.

- Cash Inflow Improvement Strategies: To enhance cash inflows from customers, consider the following strategies:

- Incentivize Early Payments: Offer discounts or incentives for customers who pay their invoices early. (we typically give a nice discount for existing customers to renew early or even pay up front). This can help improve your company’s cash position and strengthen customer relationships.

- Optimize Accounts Receivable: Monitor your accounts receivable closely and establish a robust collections process. Send timely reminders for overdue payments and consider implementing automated payment reminders. If you are getting comments from your customers to stop harassing their accounting department, you know you are doing your job.

- Streamline Billing and Payment Processes: Simplify your billing and payment procedures to ensure they are efficient and user-friendly. Consider offering multiple payment options and providing clear and concise invoices. And if you need additional KPIS on cashflow look at this free handy chart.

12. Evaluate Pricing Strategies: Regularly review your pricing structure to ensure it aligns with market trends and customer value. Every startup I’ve worked at typically underprices or jumps to a discount too early so think through the value that you provide. Identify opportunities for upselling or introducing premium features (the expand of land & expand) that can increase revenue and cash inflows.

13. Monitor and Analyze Actual Performance: Track your actual cashflow against the forecasted figures and identify any significant variances. Regularly review and analyze the reasons for these discrepancies to refine your forecasting model and improve its accuracy over time.

Accurately forecasting cashflow is vital for finance executives at SaaS companies to gain visibility into major spend areas and improve financial decision-making. By following the steps outlined in this article, you can develop a comprehensive 13-week cashflow forecast that reflects your company’s unique financial drivers.

Additionally, implementing strategies to improve cash inflows from customers will contribute to a healthier cash position and sustainable growth for your SaaS business and avoid nail biting on cash collections.

The last thing is, graph the data, and show your exec partners and the board the details of when the cash comes in, the categories of spend, and the bingo fuel date (when you run out of cash). Good luck.