Making Sure the Pipes Connect…and Avoiding the Extra Work in Excel

Let’s talk about the benefits and challenges of offshoring engineering teams for a US-based company. We all know that offshoring can save costs and give us access to a larger pool of skilled engineers. But, managing the financial accounting for international subsidiaries and branches can be a real headache, right? In this article, we’re diving into some strategies to consolidate financial statements accurately and efficiently while keeping those trial balances aligned.

Let’s break it down:

Establish a Standard Chart of Accounts: We all love consistency in financial reporting, don’t we? So, let’s implement a standard chart of accounts across all subsidiaries and branches. This means adopting the same accounting principles, policies, and procedures. Unifying the chart of accounts will make consolidating financial statements a piece of cake.

Utilize a Common Currency: Ah, the joys of dealing with different currencies! When subsidiaries and branches operate in different currencies, converting everything to a common currency is a must for consolidation purposes. It just makes the whole process simpler, accurate, and consistent. No more currency confusion and extra math.

Leverage Financial Consolidation Software: Say goodbye to manual work and hello to automation! Get yourself some dedicated financial consolidation software that can integrate and consolidate financial data from various sources. We’re talking about systems like Oracle Hyperion, SAP BPC, or even Intacct (which has a nifty module for consolidations). Let the software do the heavy lifting for you!

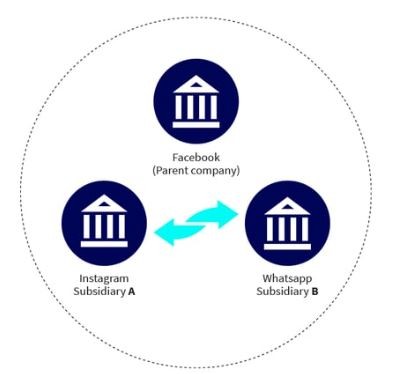

Automate Intercompany Reconciliation: Forget about spending hours reconciling intercompany transactions manually. That’s so last year! Automate the intercompany reconciliation process with specialized software solutions. You’ll save time, improve accuracy, and have real-time data at your fingertips. Let’s make those monthly closes a breeze!

Monitor Transfer Pricing: Now, transfer pricing is a whole different ball game. Make sure you’re familiar with the transfer pricing regulations and guidelines in the countries where your international subsidiaries operate. Keep an eye on those OECD guidelines and any country-specific rules. Compliance is key.

Conduct Transfer Pricing Analysis: Time to get analytical! Analyze the functions, assets, and risks (FAR) of related-party transactions. Figure out what each entity brings to the table, whether it’s manufacturing, distribution, marketing, or intellectual property development. Typically this is outsourced for a small fee. Get those numbers and functions aligned!

Foster Effective Communication: Communication is the glue that holds everything together. Make sure there’s clear documentation and standards established for consistent practices across borders. Have regular meetings or video conferences with your subsidiary accounting teams. Trust me, it makes a world of difference.

Investigate Discrepancies: Before consolidating financial statements, it’s important to identify and investigate any differences between trial balances of subsidiaries and branches. Let’s squash those discrepancies and ensure the accuracy of the consolidated financial statements. Proactivity is the name of the game!

Validate Consolidated Financial Statements: Last but not least, after completing the consolidation process, take a moment to validate those consolidated financial statements. Double-check everything, cross-reference with underlying subsidiary financials, and make sure those trial balances are in balance. It’s the final step to peace of mind!

These strategies will make your life a whole lot easier when it comes to consolidating subsidiary accounting for the parent company. Say goodbye to Excel headaches and hello to streamlined and accurate financial statements.

Feel free to share any other tips or experiences you have in the comments below.