Doing revenue recognition right takes some work when working in Quickbooks. For SaaS companies, we often have to jerry-rig the process but it does seem to work and we discuss ways to save time and get accurate financials.

Under ASC 606, SaaS businesses must follow a five-step process to recognize revenue:

- Identify the contract.

- Identify performance obligations.

- Determine the transaction price.

- Allocate the transaction price.

- Recognize revenue as the performance obligation is satisfied

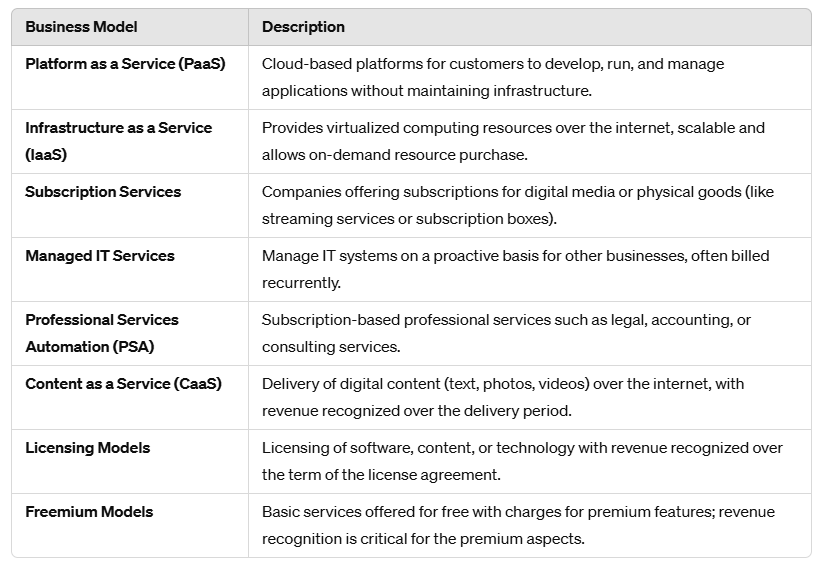

Here are some business models that may use revenue recognition.

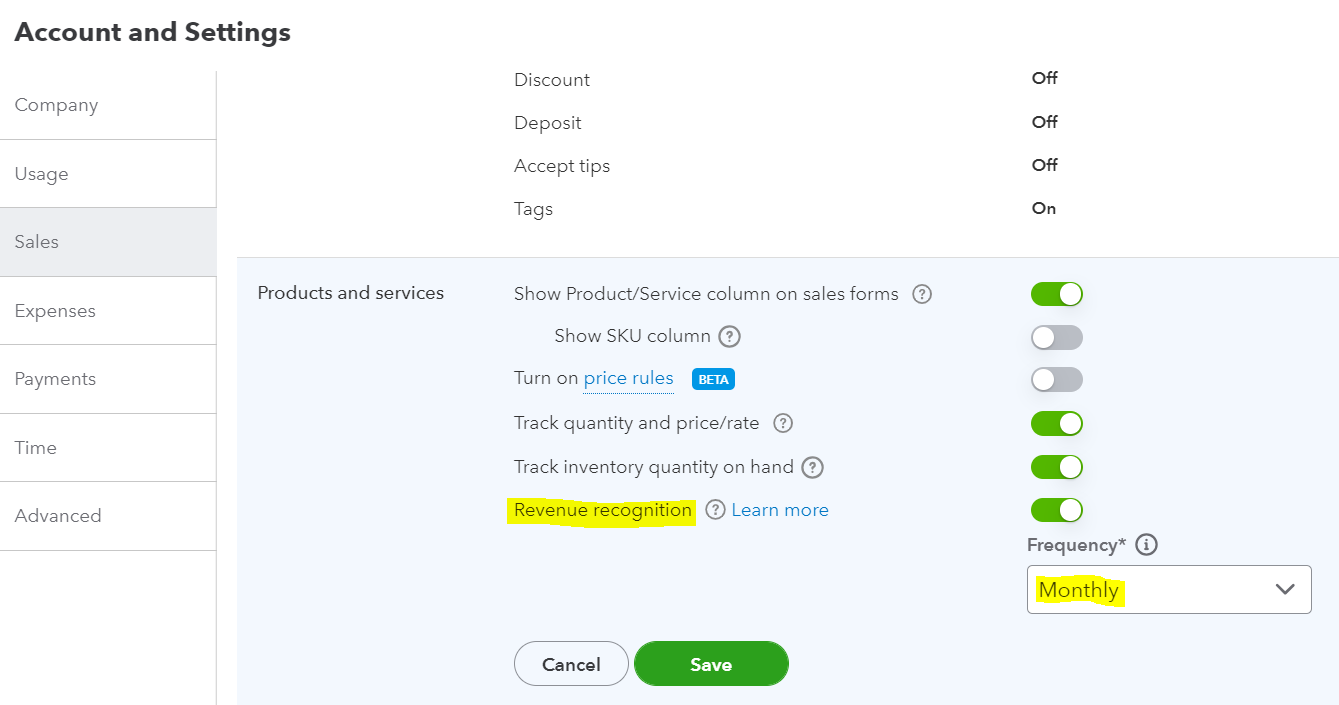

An upgrade to QuickBooks Advanced makes things a little easier since it has some built-in capabilities to help with ASC 606 revenue recognition. Here’s how we set it up:

- Enable Revenue Recognition: First, enable the revenue recognition preference under Account and Settings > Company Settings.

- Create Recognition Accounts: Set up accounts to track unearned/deferred revenue like “Deferred Revenue” under Liabilities and “Earned Revenue” under Income.

- Define Recognition Rules: Specify how you want to recognize revenue over time by creating Revenue Recognition Rules. Define the revenue type, start/end criteria, recognition method (ratable, milestones, etc.) and schedule.

- Apply Rules to Transactions: When invoicing or receiving payments, select the appropriate revenue rule . QuickBooks will initially defer the full amount to the Deferred Revenue account.

- Run Revenue Recognition: On scheduled dates, run the process to calculate the earned portion and move amounts to the Earned Revenue income account.

Set up revenue recognition to automatically schedule moving revenue from your chosen liability account to your chosen asset account. Choose the best sales strategy to maximize sales so you can then take advantage of revenue reporting.

Step 1: Turn on revenue recognition

- Go to Settings, then select Account and Settings.

- Select Sales.

- In Products and Services, select Edit ✎.

- Turn on Revenue recognition.

- Select the Frequency: Daily or Monthly.

- Select Save, then Done.

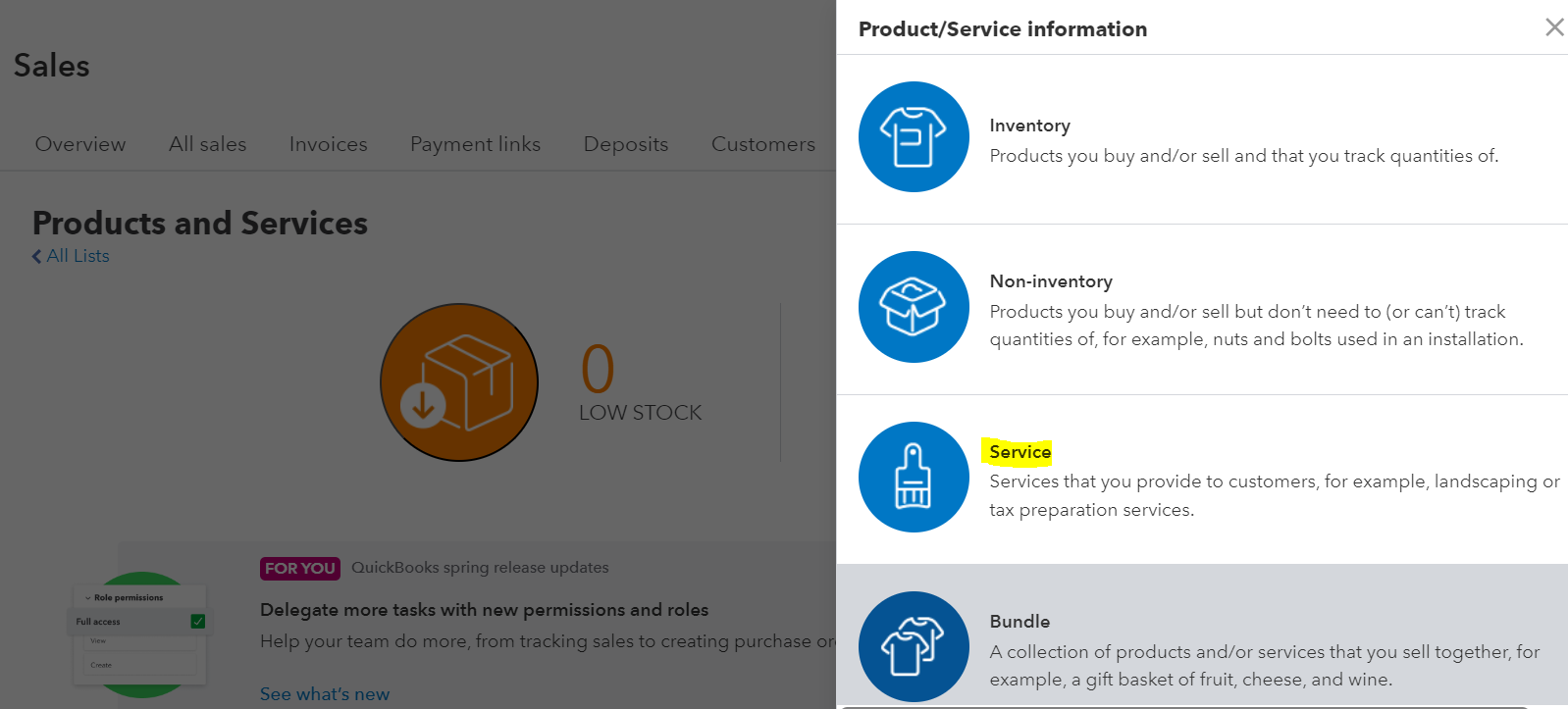

Step 2: Add a service with revenue recognition

- Go to Settings, then Products & services

- Select New, then choose Service.

- Fill out the details.

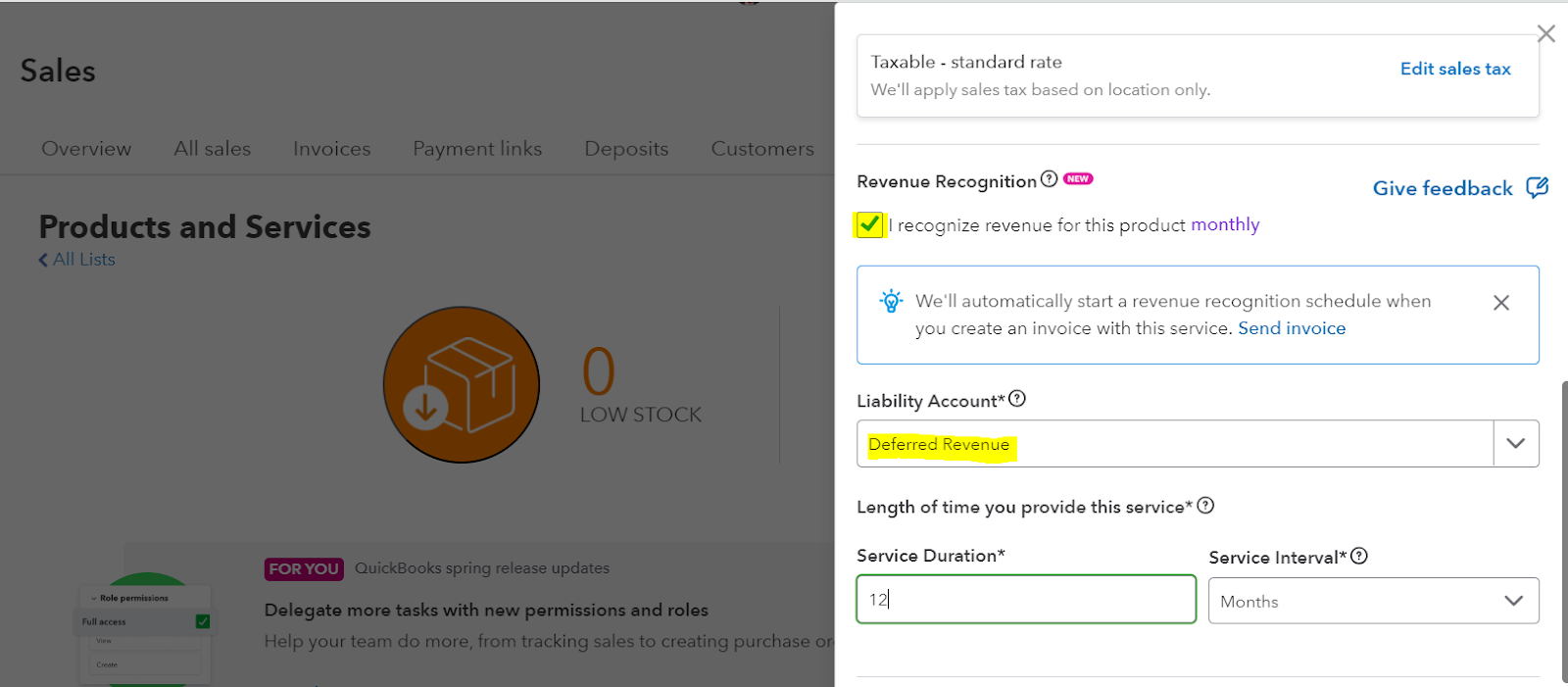

- Check I recognize revenue for this product monthly.

- Choose a Liability account and, in Service Duration, enter the number of months the revenue should be recognized over. Note: You can enter up to 60 months.

- Select Save and Close.

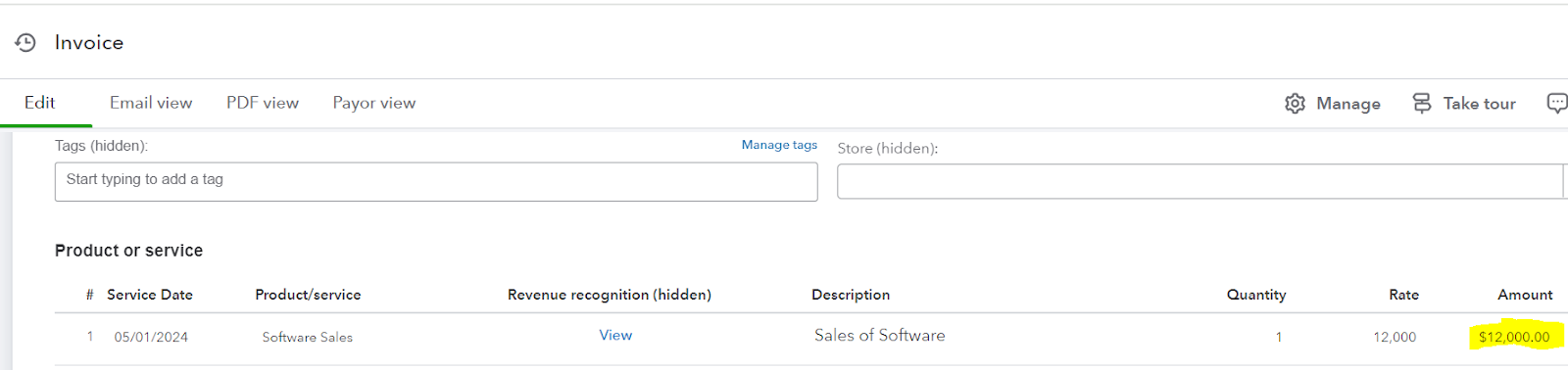

Step 3: Create an invoice with revenue recognition

Now, create an invoice for this service you just set up. The Service Date on the invoice will let QuickBooks know when to start the revenue recognition schedule.

- Go to New, and select Invoice.

- Fill out your invoice details. Be sure to add the service you just created.

- Under Service Date, choose the date this service will start. The service date can be after the close books date.

- Select Save.

- Next to the service line item, select View Revenue Recognition.

- The schedule for your revenue recognition for that service displays.

Subscriptions and Ratable Recognition

For SaaS, the core performance obligation is providing continuous access to the platform over the contract term. Revenue should be recognized as ratable over that term. For example at our company, we do it monthly. Two-year deals, and a half-year deals, are all ratable on a monthly basis.

With regard to professional services, such tasks as implementation, customization, and training are definite obligations. The fees are recognized as the service is performed, but subscription fees continue to be evenly recognized throughout.

Accommodating the Payment Terms: Under ASC 606, it is mandatory to make the adjustment for the financing effect when the payment terms are significantly in advance or significantly delayed concerning the performance timing of the obligations.

Contract Modification: If services are added to an existing agreement, you have to reallocate the remaining fee to all obligations accordingly.

Where QuickBooks alone may not fully address some of the details of the complexity of ASC 606, its revenue recognition features facilitate some essential processes such as setting up the schedule to amortize contract liabilities and to defer and recognize revenue accordingly over time.

More complex obligations, such as those needing allocation to specific obligations, require either a specialized revenue management tool or customized setup assistance. You can see a list of the finance and accounting stack here

We’ve had more success with Sage Intaact as detailed below.

Sage Intacct Revenue Recognition with ASC 606 Compliance

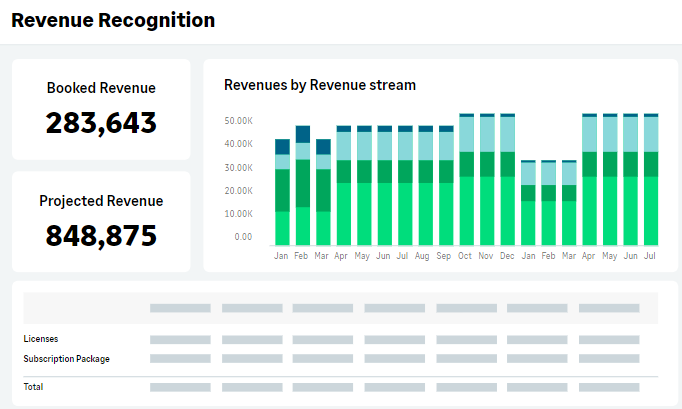

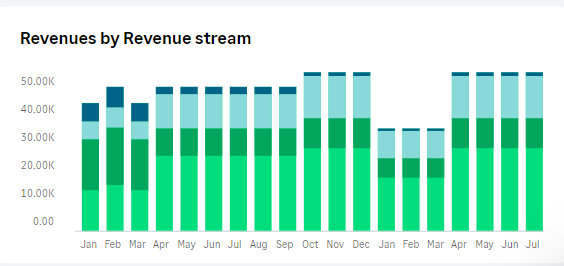

Sage Intacct takes things a little further with automation for rev rec and deferred revenue calculations. It does this by automatically determining the posting dates in revenue schedules according to the pre-configured methods and templates of revenue recognition. That means that the rev rec is automated, accurate and in compliance with ASC 606 in QuickBooks for SaaS.

Recognition Tailored for SaaS

For SaaS Subscriptions: The software assumes that the core obligations provide continuous access over the contract term. Revenue is recognized ratably, mirroring the continuous delivery of service.

When Things Get Complicated

Our SaaS company sells various bundles that include perpetual or term software licenses, SaaS subscriptions, implementation services, training, and support/maintenance. These multiple-element arrangements (MEAs) require detailed attention for revenue recognition and maintaining deferred revenue.

Under ASC 606, the bundle cannot be treated as a single unified sale. Each component, such as the software license, SaaS subscription, implementation services, training, and support/maintenance, must be identified and valued separately. This involves establishing the standalone selling price (SSP) for each distinct element using vendor-specific objective evidence or other methods like adjusted market assessment or expected cost plus margin. Only after determining the SSP can the total transaction price be properly allocated to each component for accurate revenue recognition.

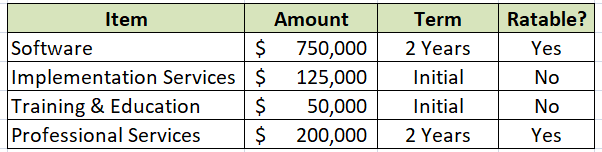

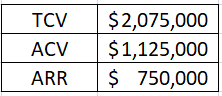

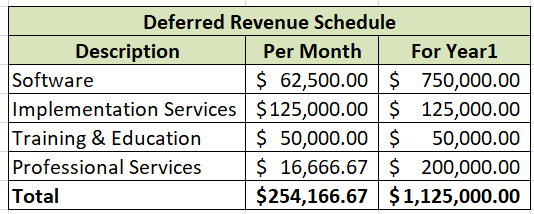

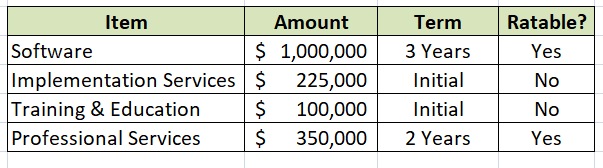

For example, we sell a two-year subscription deal for our software, implementation services, training and professional services as broken out below. The initial payment from the customer will cover the software for year one, the implementation services, the training and education (one year) and the maintenance for year one. The customer wishes to be invoiced in year two for the second year of the subscription and the professional services.

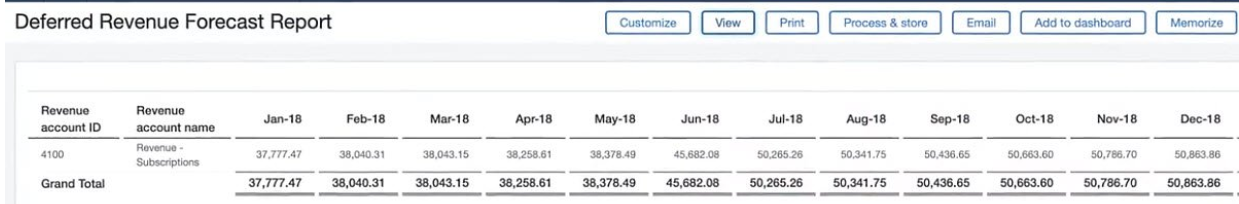

What do the deferred revenues look like in year one

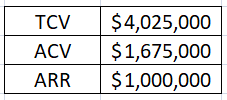

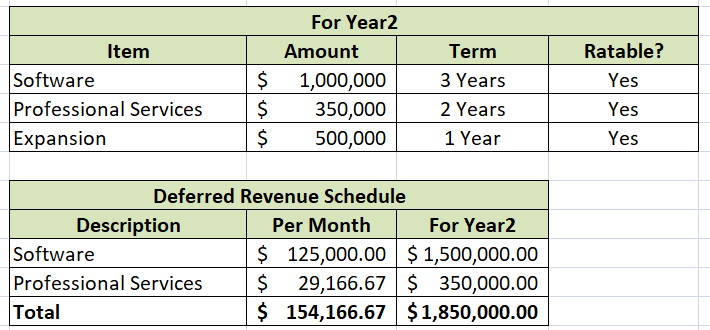

Here’s another example that is a 3-year deal paid upfront.

However, at the start of Year 2, the customer decides to expand the software license. So instead of sending an invoice for the second year for $1,350,000, we sent a bill for $1,850,000 which includes the expansion ARR of $500,000. We did not charge any more for the second year of Professional Services.

Deferred Revenue Looks like this:

In QuickBooks, it gets a little complicated dealing with deferred revenue management for multi-year contracts paid in advance or having multiple simultaneous expansions presents significant obstacles. Yes, it can be done but think about it when you have hundreds of customers each with various terms.

We use Intaact which automates the deferred revenue and balance sheet calculations simplifying revenue management and ensuring compliance with ASC606. Organizations dealing with complexities might consider switching to more sophisticated systems like Intacct which offer tailored solutions for deferred revenue management. Adopting such advanced platforms not only provides accurate financial insights but also aids in strategic decision-making, ultimately enhancing overall business efficiency.

The revenue for each element is then recognized based on its revenue model. The license value is recognized upfront upon delivery. The service revenue is recognized over the implementation period. And the SaaS subscription revenue is recognized ratably over the annual period as the service is delivered.

Adjustments for Payment Timing

ASC 606 says companies must adjust for the effects of financing when the timing between delivery and cash flow of saas companies is significant. The sophisticated revenue recognition system in Intacct allows for an automatic adjustment of these timing differences to present financial statements that represent the economic reality of the transaction.

Contract Modifications

Contract modifications, such as adding a service to an existing agreement, are part of the complexity of revenue recognition. To handle this, Sage Intacct reallocates the remaining fees across all obligations under the new contract terms. This is one of the most useful features in maintaining compliance and ensuring proper revenue recognition when contract terms change.

MacGyver, QuickBooks and Intaact

With some work, you can be ASC compliant and do things correctly in Quickbooks. With Quickbooks Advanced, take the time to set things up correctly and you can track and maintain a robust revenue schedule making the rev rec process easier. When you are ready to upgrade (we did) Sage Intaact can save you a bunch of time with the automation and helps with complex and intricate situations.