When you have large customers and they decide to stretch out payment terms all of a sudden from 30 days to 60 days while some other customers decide against multi year paid up front deals, it can really cramp your cash flow. It’s something we are wrestling with now. Companies use money coming in to pay for things so the mismatch between the two can cause some big headaches for growing companies. And if you have $250M in the bank and your sales team is crushing it, that’s one thing but most of us are still scaling to get there.

Having adequate cash flow is imperative yet increasingly difficult in this still high rate environment. Everyone wants to hold onto their cash. As businesses scale rapidly, expenses often outpace revenue growth, leading to tightened liquidity despite strong top-line performance. Delayed customer payments further exacerbate cash flow pressures as it seems everyone wants to hold on to their cash a little longer. Raising money these days? Expect even more scrutiny.

Startups and mature enterprises alike need robust frameworks for cash flow planning, forecasting, and management. Here are some guidelines that we have used:

Cash Flow Visibility

- Implement 13-week cash flow forecasts with multiple updated scenarios. This near-term visibility allows for agile decision making.

- Build forecast accuracy by analyzing historical data on customer payment cycles. Account for seasonal fluctuations and macroeconomic factors.

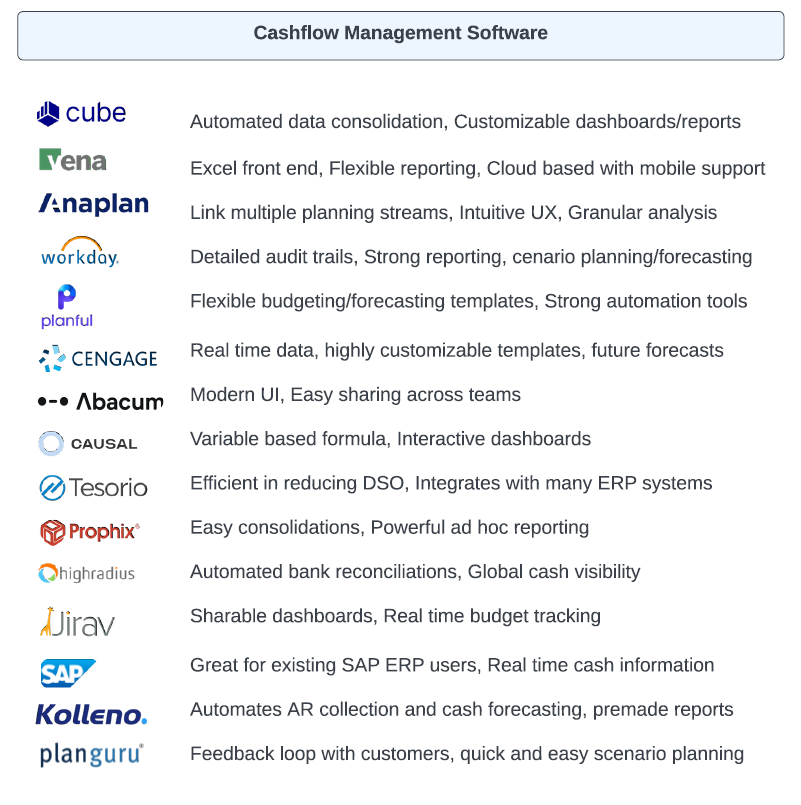

- Use cash flow analysis software to consolidate financial data automatically into interactive dashboards.

- Check your customers. If the stock market is nearing all time highs and one of your customers is at their 52 week low…prepare for some bad news.

Accelerating Receivables, Some Enticement to get paid

- Do the math, what if your top 10 customers go from net 30 to net 90 in a worse case scenario. And demanding payments to the original agreement is only going to make them mad so continue to have good dialogue with your customer and DON’T assume everyone will pay on time.

- Offer early payment discounts to incentivize customers. However, ensure discounts are still revenue-positive.

- Use e-invoicing and automated reminders to reduce Days Sales Outstanding (DSO) but do add a personal note as most of us ignore auto reminders.

- Evaluate credit terms for high-risk clients. Consider deposits, installment plans, or upfront payments.

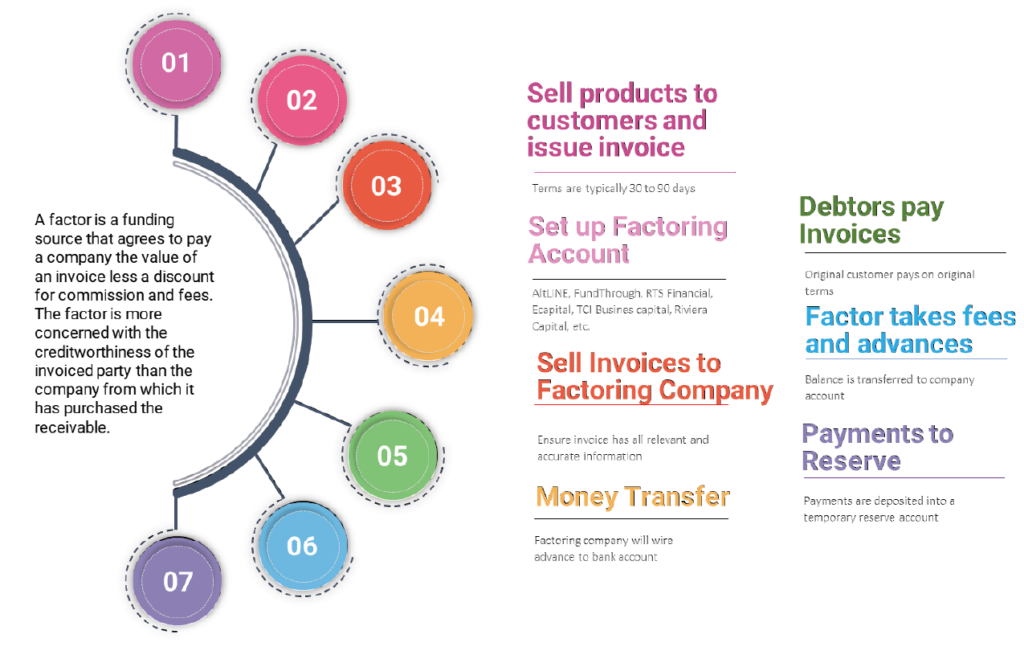

- Leverage invoice factoring when cash flow falls short. This financing option trades invoices for immediate capital access. (more on this below)

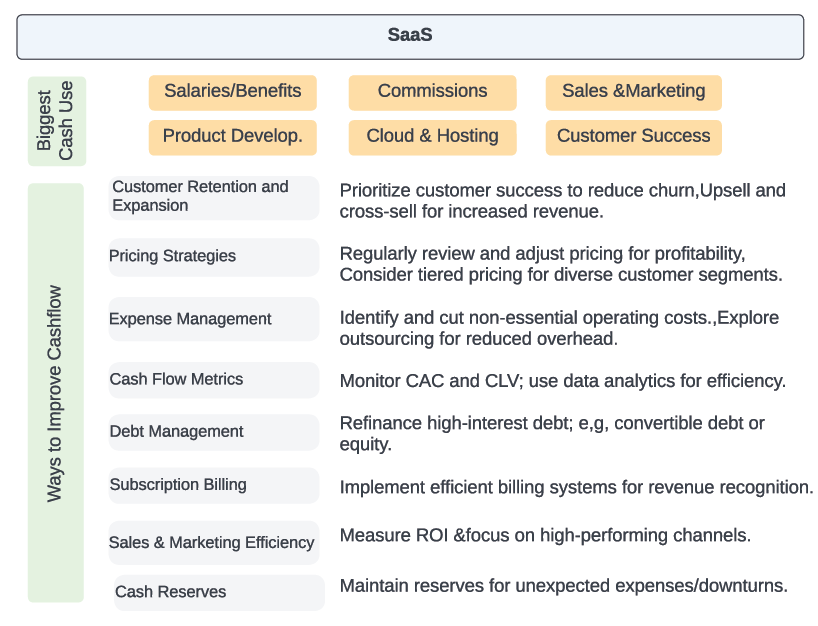

Managing Expenses

- Prioritize reducing variable costs e.g. marketing, travel, contractors. Avoid layoffs.

- Renegotiate contracts for lower fixed costs such as cloud subscriptions and software. Multi year deals? Yes, it’s cheaper but balance it with cashflows.

- Delay non-critical capital expenditures if possible until cash flow stabilizes.

Financial Planning

- Forecast, don’t extrapolate. Plan for contingencies and scenarios since many things are still fluid with the economy.

- Stress test worst-case scenarios. Model effects on operational viability and growth plans.

- Maintain an emergency fund if possible. Consider lines of credit for flexibility and do this when you can…not when you need to.

The Core Pillars of Cash Flow Management

Operational Efficiency: Ensuring timely customer payments and managing operational expenses are fundamental. Incorporating a 13-week cash flow forecast provides a near-term financial roadmap, enabling agile responses to cash flow fluctuations.

Investment and Financing: Balancing strategic investments against maintaining liquidity is vital. Effective financial structuring, leveraging both equity and debt, supports growth ambitions while managing cash flow impacts.

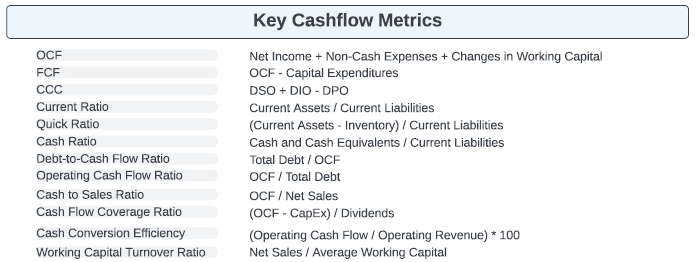

Metrics and Tools: Key measurements like the Cash Conversion Cycle (CCC), Days Sales Outstanding (DSO), and liquidity ratios offer critical insights into financial health. Utilizing cash flow management software and efficient billing systems can significantly improve operational cash flow.

What if I have Inventories?

Got inventory? Employing robust safety stock strategies based on historical data can mitigate risks associated with lead time variability. Advanced demand forecasting, leveraging techniques like time series analysis or machine learning, can improve accuracy in predicting future demands. Strengthening supplier relationships enables better insights into their production schedules, aiding in anticipation and planning for potential delays.

In extended lead times, cash flow management becomes even more critical. Options such as inventory financing can provide necessary liquidity, while order consolidation and effective cost control measures can optimize expenses. Regular updates to cash flow forecasts ensure that they reflect the latest inventory needs and sales projections.

Setting precise inventory targets involves categorizing products using ABC analysis and adopting segmented approaches for different product categories. This ensures that resources are allocated efficiently, focusing on items that require more attention. Implementing dynamic reordering policies that adjust to the current market conditions can maintain optimal stock levels.

Diversifying the inventory can help balance the risks associated with demand unpredictability, ensuring that the company remains resilient in the face of change.

When Factoring Makes Sense

Loan sharks, they are circling the waters these days. Selling your accounts receivable to a third party (factor) at a discount, can provide immediate cash flow to your business. It’s an option to consider under certain circumstances, but it’s important to weigh the costs and benefits. Here are some situations when you might consider factoring your receivables:

Immediate Cash Needs: If your company is in immediate need of cash to cover essential expenses such as payroll, rent, or urgent projects, and you cannot wait for the usual credit terms to expire, factoring can provide quick access to cash.

High Growth Periods: During periods of rapid growth, your company might need more cash than your operating cash flow can support. Factoring can provide the necessary funds to support expansion, such as hiring new employees, purchasing inventory, or expanding operations.

Inadequate Credit Management Resources: If your company lacks the resources or expertise to manage credit effectively, including conducting credit checks and managing collections, a factor can take over these responsibilities, allowing you to focus on your core business operations.

Difficulty Obtaining Other Financing: If traditional financing options are not available to your company due to a lack of collateral, a short operating history, or poor credit, factoring can be an alternative way to access funding.

Seasonal Fluctuations: For businesses with seasonal sales cycles, factoring can smooth out cash flow during off-peak times, ensuring that the business can continue to operate smoothly and prepare for the high season.

Long Payment Cycles: If your customers typically take a long time to pay and this is causing cash flow issues, factoring can help by providing you with the majority of the receivables value upfront.

Recourse: If your customer fails to pay their invoice to the factor, you must pay back the recourse factoring company for the amount advanced. Adds risk for you but offers lower fees.

Non-Recourse: In non-recourse factoring, if your customer fails to pay their invoice to the factor, the factor assumes responsibility for the loss, not your business. Think lower risk, but higher fees.

Spot Factoring: Spot factoring allows you to factor only one invoice. Let’s say you have one large outstanding invoice that you need paid now, a spot factor will fund that one invoice alone.

Whole Ledger Factoring: Whole Ledger factoring means that the factoring company requires that you factoring all of your invoices together. Some businesses don’t have payment delay issues across all customers, so this may not be preferable.

https://www.nerdwallet.com/article/small-business/factoring-company

https://www.forbes.com/advisor/business-loans/best-factoring-companies/

By implementing data-driven cash flow management, tech companies can drive efficiency, growth, and resilience. The combination of financial visibility, working capital optimization, expense control, and scenario planning is key to navigating volatility.

#cashflowmanagement #workingcapitalmanagement #cashflowforecasting #financialmanagement #businessfinance #cashflowanalysis #financialforecasting #cashflowinvesting #revenuecyclemanagement #operationalefficiency #financetips #expensemanagement #budgeting #financialplanningandanalysis #businessstrategy