Secured vs Unsecured Debt and Understanding Subordination

So you want to borrow money for your growing startup? In part 3 of our discussion on debt, we discuss the importance of secured and unsecured debt and how subordination comes into play as you add debt holders to your current list of equity investors.

Here’s an overview of key considerations:

Balancing Secured and Unsecured Debt:

- Secured debt offers easier access to financing, flexible terms, and lower interest rates by providing collateral, such as company assets, property, or accounts receivable. However, defaulting on secured debt poses the risk of losing valuable assets.

- Unsecured debt, although more challenging to secure, eliminates the risk of asset loss. Lenders charge higher interest rates and impose stricter repayment requirements due to the increased risk.

Assets Considered for Securitization:

- Equipment and Machinery: Valuable equipment or machinery can be securitized, allowing banks to create securities backed by their value and use them as collateral for loans. If you are a hardware company you might have some specialized equipment but for the most part you will be using a contract manufacturer based in China or commodity hardware servers.

- Real Estate: Most companies don’t but If our company owns real estate, such as office buildings or warehouses, the bank can securitize the property’s value through commercial mortgage-backed securities (CMBS). Prior to Covid, many CFOs calculated the value of owning real estate vs. leasing and now wrestling with employees that dont want to return full time to the office.

- Inventory: Companies with significant inventory levels can securitize their inventory by creating securities backed by its value and using them as collateral for loans. Finished goods may be a big item but remember lenders will typically discount your inventory due to obsolescence.

- Accounts Receivable: Banks can securitize outstanding invoices or receivables, bundling them as asset-backed securities (ABS) to provide immediate cash. Lenders will look at the types of receivables and also the credit worthiness and payment history of your customers.

- Intellectual Property: Certain intellectual property assets, like patents or trademarks, can be securitized by creating securities based on their value and using them as collateral for loans. Essential and non-essential patents (get the files ready from your DropBox) will all be reviewed. This is a very delicate issue when it comes to patents so think it through carefully.

- Future Cash Flows: In some cases, banks can securitize anticipated future cash flows based on projected revenues, contracts, or reliable income streams.

One important note: Most startups will be in a net burn situation and a growing company may resort to financing based on future Annual Recurring Revenue (ARR) when traditional metrics like EBITDA are not yet meaningful.

ARR financing is used for SaaS companies where subscription-based services generate reliable recurring revenue, and there is an understanding that a nascent business with significant startup costs can scale up quickly.

ARR financing documents are similar to traditional leveraged documents, but instead of relying on EBITDA, they utilize leverage tests based on ARR. (Lenders are smart and they will take out Maintenance, consultancy, or service fees from your ARR calculations).

ARR leverage tests are used to make sure that you don’t go over a threshold and can service your debt. There may also be a liquidity covenant to ensure the company has sufficient cash reserves to handle potential performance challenges and adjust its workforce if needed (since the headcount will typically be the biggest component of your cost).

ARR financings often incorporate Payment-in-Kind (PIK) toggles to accommodate cash constraints during the initial growth phase. The loan agreement typically includes a “flip” provision, transitioning from the ARR leverage test to a traditional EBITDA leverage test after a specified period, typically two to three years. This aligns with the company’s projection of achieving substantive profitability in the future.

Understanding Subordination:

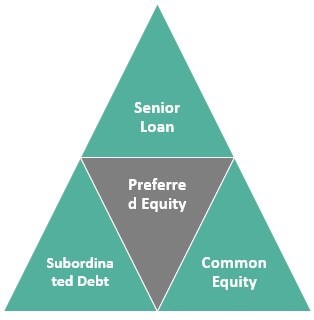

- Lenders play a crucial role in determining the prioritization of creditors’ claims in subordination. Senior lenders are typically repaid first in bankruptcy scenarios, protecting their higher priority status.

- Subordination helps lenders manage risk by providing senior lenders with priority access to assets and cash flows. Senior lenders may have a first lien on specific assets, such as real estate or equipment, ensuring a more secure position for repayment.

- The subordination hierarchy impacts a company’s capital structure and attracts different types of investors. Senior debt may be more appealing to conservative investors seeking lower risk, while subordinated debt may attract investors looking for higher returns.

- Subordination terms are outlined in legal agreements and significantly impact lenders’ risk exposure and repayment prospects. Intercreditor agreements specify the rights and priority of different lenders, ensuring clarity in default or bankruptcy scenarios.

- Don’t skimp on the legal review of loan documents, it’s super important to understand the fine print and make sure you understand all the covenants and details.

Don’t Go Crazy with Debt

Think of the situation when you are about to raise a Series C round and the equity investors find all this debt on your balance sheet. A reasonable amount is fine (and it might not matter if your company is performing well), but no one wants to give you money to service your debt, so think it through and make sure your overall capitalization makes sense.