What’s The Cash Position?

Ask a CFO of a Series A, B, or C venture-backed company to predict their cash runway with precision and the usual response is well, it depends. Now opex is not too difficult to calculate since it’s mostly headcount, cloud costs, marketing programs, and some remaining items to get to the gross cash burn. The issue is when it comes to forecasting cash coming in. Interest income aside, one has to be detailed when it comes to cash from renewals but also cash from new customers. In this series, we discuss why forecasting is difficult overall and how CFOs can add some precision with the right tools.

CFOs have been busy over the past few quarters recasting their financial model. Forecasting an enterprise SaaS business can be challenging, and accuracy depends on many factors, including historical data, market analysis, and how the Account Executives (AEs) have been hitting their targets. If salespeople do not achieve their attainment or are inconsistent, it can impact the accuracy of the forecast. And remember one has to be thoughtful of how new AEs ramp and start to contribute.

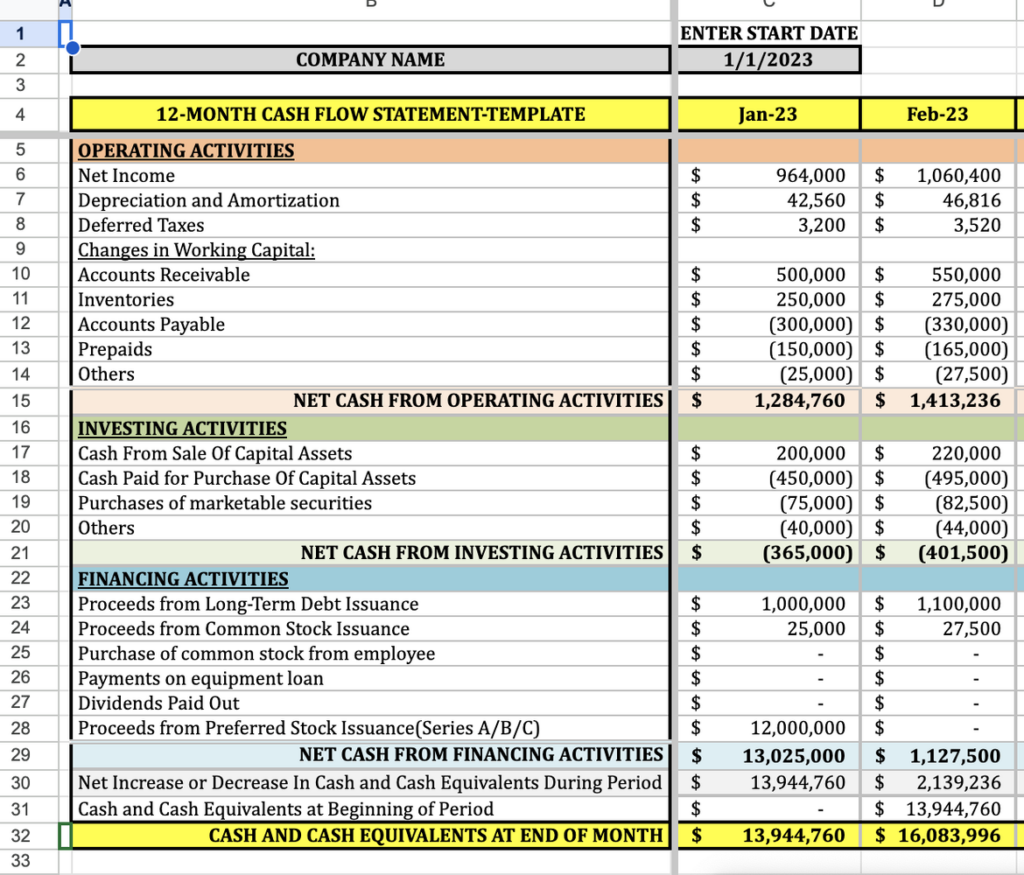

For an easy-to-use cash flow model, shoot me a message at info@strativ.co and I can send you my Excel template. It works well for software companies (Series A, B, C) with no inventories. Here is a google sheets version as well (CASH FLOW STATEMENT-TEMPLATE V1.0).

The big drivers of cash coming in are accounts receivables, so make sure to focus on collections (we will dive deeper into this in part 2).

Here are some ways to make cash flow forecasting more Precise:

Historical Trends with Refinement

Salespeople hitting their numbers at a specific quota can make it easy to extrapolate into the future. And if things are still healthy with your end markets and nothing has changed competitively, you can work backward from a target ending ARR growth rate. However, when using historically trended information to forecast cash inflows, one potential problem is that historical trends may not always be a reliable indicator of future performance. For example, if there were one-time events or anomalies in the past that led to a spike in sales (such as a large whale customer) it may not be reasonable to expect those events to occur again in the future. And remember, markets mature and it’s not going to be the same every year for AEs to meet or beat their quotas.

Plug in the SalesForce data

If there is a direct connection between Salesforce.com (SFDC) into your finance systems such as Intaact or Netsuite, you will be able to extrapolate the top-line growth and subsequently the cash collection from new customers.

Consider nonetheless that when using pipeline data from a CRM system to forecast cash inflows, the accuracy of the data may diminish over time. This is because sales opportunities can change, be delayed, or fall through, and it can be challenging to keep the pipeline data up-to-date. Additionally, salespeople may be inconsistent in how they enter data into the CRM system, which can further reduce the accuracy of the data. I’ve seen things fall out of the “commit” stage once in a while so a hard definition (and agreement of various stages) needs to be agreed upon.

Scrub and Scrub the Pipeline

Adjust sales assumptions: If salespeople are not meeting their targets, adjust the sales assumptions used in the forecast. This might include revising the sales pipeline and adjusting conversion rates,

And it’s best practice to have a good dialogue between sales and marketing and what constitutes a “qualified lead”. One company I’ve worked with had a huge pipeline but looking deeper some of these leads were not going to convert so make sure to scrub the data if you are relying on it to build a base to forecast. And the factor rate, don’t forget to adjust it and have an explanation of this rate since the board always asks.

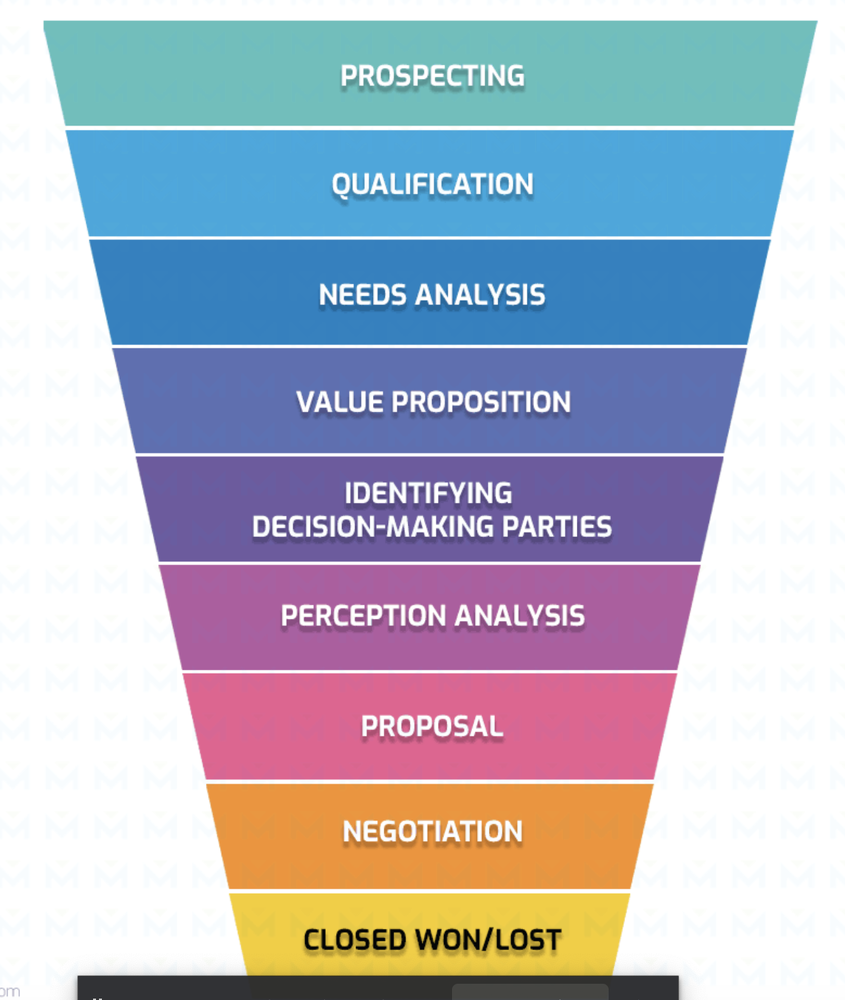

MQL to SQL and the Math of Coverage

Enough coverage starting the year means one can extrapolate the ending ARR with contributions of new ARR and expansion ARR. As a rule of thumb, one should have 4X the coverage to hit the targets for the year. By itself, however, using a marketing funnel to forecast cash inflows can also have its challenges. For example, the marketing funnel may not consider the sales reps’ capacity to handle leads, and it may not take into account qualitative information such as customer feedback or market conditions. Additionally, the marketing funnel may not reflect the complexities of the sales process, such as the need for multiple touchpoints with a customer before a sale can be closed.

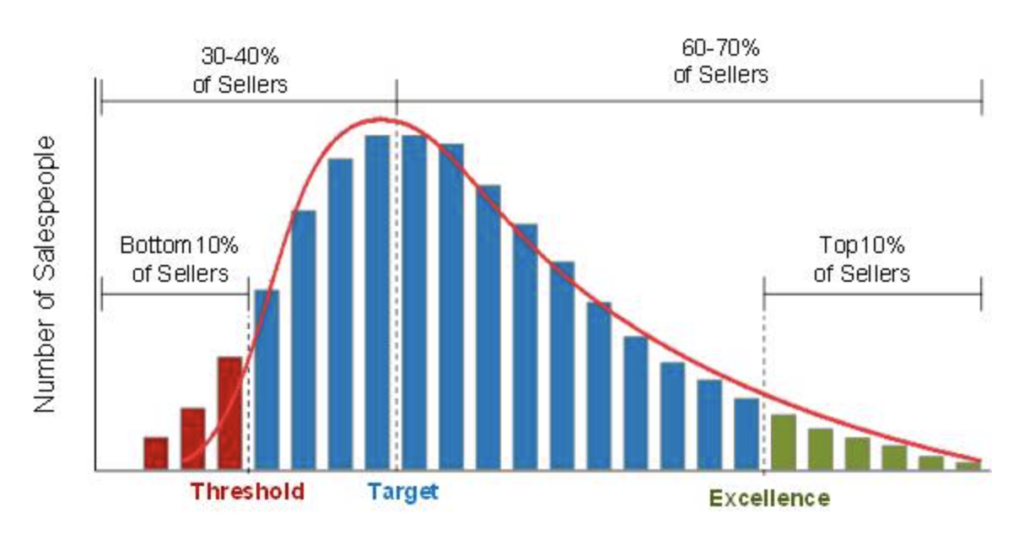

Also take a look at this article from the Alexander Group which discusses sales attainment. Most companies that I have helped have very similar distributions (stars and some near the back end).

Use a Mosaic That’s Right for You

To address these issues, a CFO may need to use a combination of approaches and data sources to forecast cash inflows with greater accuracy. This composite approach may help when it comes to building a forecast. Additionally, it may be helpful to establish a process for identifying and addressing potential anomalies or unusual events that could impact cash inflows.

Stay Tuned

In Part 2, we will discuss ways to improve the cash conversion process so that once a detailed topline forecast is completed, we can better calculate the renewals, new ARR, expansion ARR, the collections, and improve the velocity of all the money coming in vs slowing the pace of payables. Combined with all these tools, the CFO will be able to increase the precision of his or her cash forecasts.